The decision to acquire a second citizenship is significant, often driven by many factors such as enhanced global mobility, economic diversification, and the pursuit of a better quality of life.

However, choosing the right program that aligns with your specific goals and needs is crucial. In this article, we will delve into the details of the Antigua vs St Lucia citizenship by investment programs, comparing their respective benefits, requirements, and potential advantages to help you make an informed decision on your path to securing Caribbean citizenship.

Whether you’re looking for a tropical escape, a foothold in the global marketplace, or a combination of both, this comparative analysis will help you navigate the world of Caribbean citizenship.

Caribbean Citizenship by Investment Program Benefits

Fast application process

Minimum investment starts from $100,000

Multiple investment options

Family eligibility

No residency requirements

Favorable tax environment

Visa-free travel to over 140 countries

Dual citizenship

Calculate your cost of citizenship, including all associated fees.

Antigua vs St Lucia Citizenship: The Main Points

Antigua and Barbuda Citizenship by Investment | St Lucia Citizenship by Investment | |

Application Time | Three to four months | Three to four months |

Global Passport Ranking | 59th. Visa-free travel to Hong Kong, Russia, Singapore, the UK, the Schengen Zone, and more. | 75th. Visa-free travel to Hong Kong, Singapore, the UK, the Schengen Zone, and more. |

Qualifying Investment | NDF: Minimum donation of $100,000 (single applicant or family of four) Real estate: $200,000 minimum investment Business investment: $400,000 minimum investment UWI Fund: $150,000 minimum donation | NEF: Minimum donation of $100,000 (single applicant) / $150,000 (family of four) Real estate: $200,000 minimum investment Enterprise investment: $1,000,000 minimum Government bonds: $300,000 minimum investment |

Taxes | No income tax on foreign income, wealth tax, gift tax, inheritance tax, or capital gains tax. | No income tax on foreign income, wealth tax, gift tax, inheritance tax, or capital gains tax. |

Residency Requirements | Five days during the first five years of citizenship. | No stay requirements. |

Family Eligibility | Inclusion of spouse or future spouse, dependent children under 30, dependent siblings, parents and grandparents aged 55 and over. | Inclusion of spouse, children under 30, siblings under 18 (unmarried with no children), parents and grandparents aged 55 and over. |

Application Requirements | No language requirements. | No language or residency requirements. |

Who can apply for citizenship?

To make an application for citizenship through either of these programs, the main applicant must fulfill the following requirements:

- Be over 18 years old

- Be able to demonstrate an outstanding character

- Be in excellent health

- Have a clean criminal record

- Pass a detailed background check

Antigua and Barbuda Citizenship Program

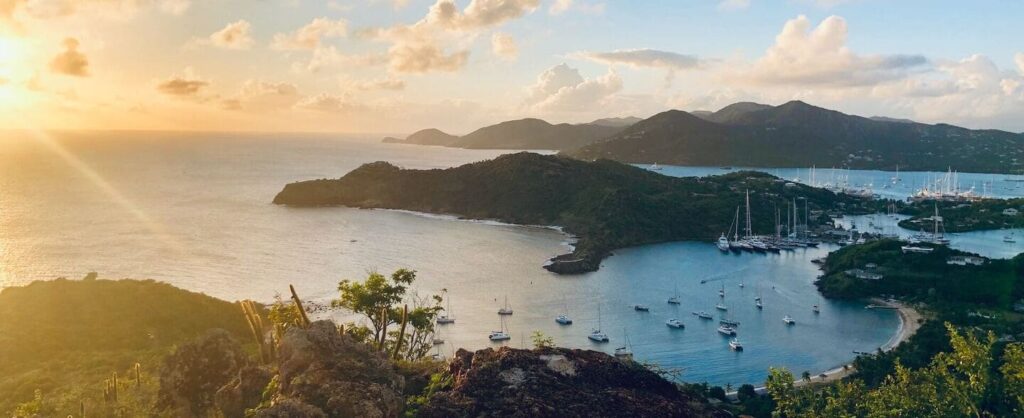

Antigua and Barbuda is a stunning nation in the Caribbean famous for its 365 beaches, sparkling waters, popular carnival celebrations, and historical sites. With everything from delicious local dishes, tourist attractions, and outdoor activities to great weather and a straightforward path to citizenship, there’s not much that Antigua and Barbuda does not offer.

Established in 2013, the Antigua and Barbuda Citizenship by Investment Program is a quick and relatively affordable way for investors and their families to obtain Caribbean citizenship by making a qualifying investment in the country.

Investment options

The program offers four investment routes by which applicants can obtain citizenship on the island:

- Non-refundable donation of at least $100,000 to the Antigua and Barbuda National Development Fund (NDF)

- Non-refundable donation of at least $150,000 to the University of the West Indies (UWI) Fund. This option is geared towards families of at least six members and entitles one of the applicants to a one-year scholarship to the university.

- Minimum investment of $200,000 in government-approved real estate or shares of real estate projects. The investment must be held for five years

- Minimum investment of $400,000 in an enterprise worth $5,000,000, or a $1,500,000 investment as a solo investor

In addition to the minimum contribution amount, applicants will be required to pay additional fees such as due diligence fees, processing fees, and passport fees.

Antigua and Barbuda citizenship benefits

Antigua and Barbuda citizens benefit from the island’s relaxed tax environment, which includes no income tax on foreign income, capital gains tax, inheritance tax, or wealth tax. You will also find quality healthcare and education systems on the island. In fact, Mount St John’s Medical Center is the most modern hospital on the Caribbean islands. The country’s economy depends primarily on the agricultural, banking, and tourism sectors and provides plenty of investment opportunities. Furthermore, the cost of living on this Caribbean island is around 20 percent lower than in most countries in Northern America and Europe.

Antigua and Barbuda passport

The Antigua and Barbuda passport ranks 59th on our Global Passport Index, based on factors such as enhanced mobility, quality of life, and economic investment, and is valid for five years. Antigua and Barbuda passport holders enjoy visa-free access to over 140 destinations, such as the Schengen Zone, Hong Kong, Russia, and Singapore.

Get in touch with a Citizenship by Investment Specialist

Our team of industry-leading experts will help you with everything from filing your immigration application to providing professional legal and tax advice. We are wholly committed to your success.

St Lucia Citizenship Program

Famous for its lush vegetation, iconic sites, and popularity among honeymooners, St Lucia is an excellent choice if you are looking to start a more laidback life in a slice of Caribbean paradise. The island is also an excellent location for business, with a variety of investment opportunities available thanks to the country’s agriculture, fishing, and tourism industries – and of course, its citizenship by investment program.

Investment options

Established in 2015, St Lucia’s CBI program offers four investment routes to obtain citizenship:

- A minimum contribution to the National Economic Fund (NEF) of $100,000 for a single applicant or $150,000 for a family of up to four

- Investment of at least $200,000 in pre-approved real estate projects

- Investment of at least $300,000 in non-interest-bearing Government Bonds

- An enterprise investment of at least $3,500,000 as a solo investor or $1,000,000 as part of a joint $6,000,000 venture

Additional fees include processing fees, due diligence fees, passport fees, and government fees.

St Lucia citizenship benefits

St Lucia citizens benefit from a favorable tax environment where you do not pay income tax on foreign income, wealth, or inheritance tax. The nation is continuing to develop its infrastructure and improve its airports, hospitals, accommodations, and marinas. This development has further attracted tourists and investors interested in visiting and investing in the island. In addition to this, the cost of living is relatively low compared to places like the UK and the US.

St Lucia passport

Ranked 75th on our Global Passport Index, St Lucia passport holders benefit from visa-free access to over 140 countries across the globe. The passport is valid for five years following the granting of citizenship. Once it has been renewed it will be valid for ten years.

Which program is right for you?

In this section, we’ll compare the pros and cons of citizenship in Antigua vs St Lucia under a few key points.

Tax benefits

Both countries offer advantageous tax environments and policies from which citizens can benefit.

Visa-free countries

Visa-free travel with Antigua and St Lucia citizenship is similar, with both passports providing visa-free access to over 140 countries.

Investment options

Both CBI programs offer multiple investment options, including a fund donation, real estate investment, and business investment. St Lucia also offers the option of investing in government bonds.

Dual citizenship

Both countries recognize dual citizenship.

Flexible requirements

The application process for both programs takes between three and four months and can be completed remotely. Neither program has an education or language requirement. Both St Lucia and Antigua require applicants to partake in a mandatory online interview, while Antigua and Barbuda also requires successful CBI applicants to spend five days in the country during the first five years following the acquisition of citizenship.

Family inclusion

The Antigua and Barbuda CBI program allows for the inclusion of the following family members:

- Spouse or future spouse

- Children younger than 18 years old

- Children between the ages of 18 and 30 who are supported by the main applicant or spouse (as well as their spouse and dependent children)

- Dependent children aged 18 and over who are mentally/physically challenged

- Parents or grandparents of the main applicant or spouse who are 55 years or older and financially dependent on the main applicant or spouse

- Unmarried siblings of the main applicant or spouse

A further advantage of the Antigua and Barbuda citizenship program is that it allows for the later inclusion of family members at any time following the conclusion of the citizenship process, at an additional fee.

The St Lucia CBI program allows for the inclusion of:

- Spouse

- Children of the main applicant or spouse under 21; between 21 and 30 and fully supported by the main applicant or spouse; 21 or over and mentally/physically challenged

- Parents and grandparents of the main applicant or spouse aged 55 and above

- Siblings of the main applicant or spouse who are unmarried, without children, aged 18 or younger, and have received consent from their parent or guardian to apply for citizenship by investment

Antigua and Barbuda CBI strong points

- Most affordable route for larger families thanks to the NDF ($100,000 donation) and the UWI Fund ($150,000 donation)

- More affordable business investment option starting from $400,000

- Higher rank of 59th on the Global Passport Index

St Lucia CBI strong points

- More diverse investment options (fund donation, enterprise investment, real estate, and government bonds)

- Affordable investment options starting at $100,000

- No residency or visitation requirements to maintain citizenship

Keep reading

You may be interested in our other Caribbean citizenship comparison articles:

- Caribbean Citizenship by Investment Comparison

- St Kitts vs Dominica Citizenship

- St Lucia vs Dominica Citizenship

- Grenada vs Dominica Citizenship

- Grenada vs St Kitts Citizenship

- Grenada vs St Lucia Citizenship

- St Kitts vs St Lucia Citizenship

- Antigua vs Grenada Citizenship

- Antigua vs St Kitts Citizenship

- Antigua vs Dominica Citizenship

Why work with Global Citizen Solutions?

- Global approach by local experts. We are corporate members of the Investment Migration Council, with local expertise in all five Caribbean citizenship programs.

- 100 percent approval rate. We have never had a case rejected and will offer you an initial free-of-charge due diligence assessment before signing any contract.

- Independent service and full transparency. We will present to you all the investment options available, and all expenses will be discussed in advance, with no hidden fees.

- An all-encompassing solution. A multidisciplinary team of immigration lawyers, investment specialists, and tax experts will take into consideration all your and your family's mobility, tax, and lifestyle needs.

- Confidential service and secure data management. All private data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

Get in touch with a Caribbean Citizenship by Investment specialist

Frequently Asked Questions about Antigua vs St Lucia Citizenship

The primary difference between the Antigua and St Lucia citizenship programs comes down to their investment options, stay requirements, and interview requirements. St Lucia offers more diverse investment options, while Antigua and Barbuda’s business investment route is more affordable. Antigua requires successful applicants to spend five days in the country during the first five years of citizenship and St Lucia requires applicants to partake in a mandatory virtual interview.

The best Caribbean citizenship program will depend on your individual situation and requirements. St Kitts and Nevis offers the longest-running CBI program, while Antigua and Barbuda, Dominica, and St Lucia offer the most affordable investment options for individual applicants. For families of six or more, Antigua’s University of the West Indies Fund offers the most affordable route to citizenship. In terms of benefits, all of the programs offer visa-free travel to over 140 countries, favorable tax environments, and fast application processes.