The popularity of Caribbean real estate investment among foreign investors has surged, fueled by the introduction of several Caribbean citizenship by investment programs. As demand from tourists and real estate investors continues to rise, property owners across the Caribbean, offering both luxury and affordable accommodations, reap the rewards of a thriving property market.

Furthermore, property prices in the Caribbean are comparatively more affordable than those in European countries. This means that for investors considering luxury properties or commercial real estate, the Caribbean offers the potential to secure larger and more lucrative investments for their capital.

The Benefits of Buying Real Estate in Caribbean Countries

Buying Caribbean real estate can be a path to Caribbean citizenship and a second passport through citizenship by investment programs (CBI).

- With a passport from a Caribbean country like Antigua and Barbuda, you can access more than 150 countries worldwide visa free, including the UK and EU countries.

- Many Caribbean countries offering CBI are tax-friendly and provide additional tax incentives to real estate investors, with lower transfer and property taxes.

- Cheap Caribbean countries, like Dominica and St Lucia, offer luxury property by the Caribbean Sea at a lower cost.

- Caribbean property values are steadily rising, and foreign nationals and real estate investors alike can secure lucrative long-term investments.

Caribbean Citizenship by Investment through Purchasing Real Estate

International buyers can obtain Caribbean citizenship by buying property in one of five Caribbean islands.

Country Minimum Investment Type of Property Ownership Mandatory Ownership Period Antigua and Barbuda $200,000 Sole Five years

Grenada $220,000 Joint Five years

Dominica $200,000 Sole Five years

Saint Kitts and Nevis $400,000 Joint Seven years

Saint Lucia $200,000 Sole Five years

Rental Income in the Caribbean Property Market

Many international buyers consider the Caribbean real estate landscape to secure rental property. Determining the current rental yield and potential rental earnings is crucial before buying real estate in the Caribbean.

Annual rental income

Country | Profitability |

Antigua and Barbuda | 4 percent |

Grenada | 4.3 percent |

Dominica | 4 to 5 percent |

Saint Kitts and Nevis | 5.11 percent |

Saint Lucia | 3.57 percent |

The average rental price for a government-approved apartment, villa, or hotel accommodation purchased to acquire Caribbean citizenship is $1,500 to $2,500 per week. Foreign buyers can expect an annual rental yield of three to five percent.

Approximate cost of renting a three-bedroom apartment

According to data from Numbeo, the below prices are the average prices to rent a three-bedroom apartment in Caribbean countries offering a Caribbean passport.

Country | Rent Per Month |

Antigua and Barbuda | $4,200 |

Grenada | $2,900 |

Dominica | $2,303 |

Saint Kitts and Nevis | $4,300 |

Saint Lucia | $2,267 |

Choosing Real Estate in the Caribbean

It’s common to purchase multi-room apartments in gated communities to earn rental income. Besides buying physical properties, investors can purchase real estate, including land for agriculture or a yacht dock. The primary requirement to buy real estate and obtain Caribbean citizenship is that they’re pre-approved for the investment program.

Why are approved real estate projects a good investment?

- You’ll qualify for Caribbean citizenship when you purchase real estate.

- Approved projects undergo rigorous vetting by government agencies, ensuring increased protection against fraud.

- All approved projects are located in sought-after areas, typically near tourist attractions that draw tourists year-round.

- Investing in approved government projects during the construction phase could potentially result in a more affordable real estate purchase and shortened construction timelines, decreasing overall expenses.

- Property management companies assume all maintenance expenses, including managing and upkeeping the property.

Are there restrictions in purchasing and reselling Caribbean investment property?

Caribbean CBI countries have specific zoning laws and may restrict specific investment properties. For instance, investors in Antigua and Barbuda can only sell their investment properties twice. Meanwhile, the Dominican government prohibits foreigners from buying land to build custom houses.

Take a look at our comparison between Antigua vs St Kitts Citizenship by Investment

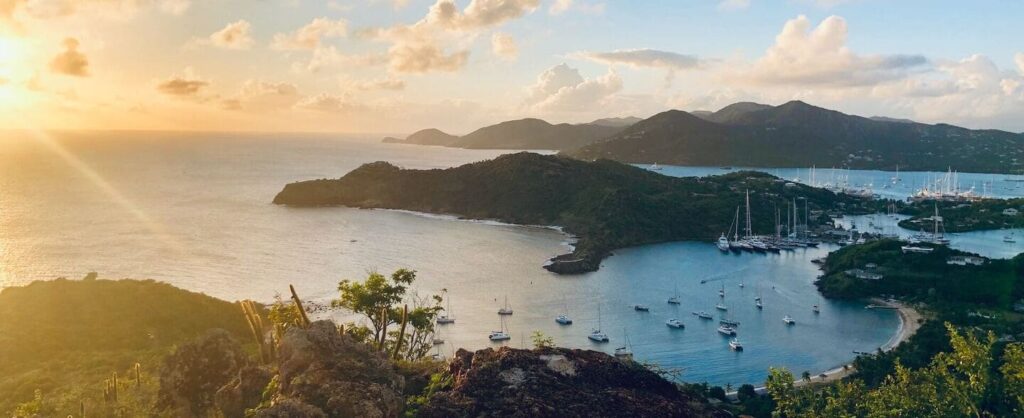

Antigua and Barbuda Real Estate Investment

The Antigua and Barbuda real estate market presents a lucrative opportunity to buy property, including investments in resort developments, and obtain Caribbean citizenship. Investors can benefit from their real estate investment and a powerful Caribbean passport.

Benefits of real estate investment

- Consistent property prices

- Various pre-approved property types are available – from city apartments to beach-facing luxury villas.

- Tax friendly, with no local or worldwide income tax, wealth tax, capital gains tax, inheritance tax, or other personal taxes.

- Obtain Antigua and Barbuda citizenship by investment with a $200,000 real estate investment.

Average Antigua and Barbuda real estate prices

Prices for real estate in Antigua and Barbuda range from $255,000 to $12 million. Investors can buy a one-bedroom apartment for around $250,000. A 22-acre private island commands a price of approximately $1 million. On average, a two-bedroom villa in the North Finger of Jolly Harbour costs about $265,000. A 12-bedroom commercial building for tourism in St Johns costs $395,000 and above.

Dominica Real Estate Investment

Those seeking the cheapest Caribbean islands will be drawn to Dominica real estate. The country is the cheapest Caribbean country to purchase property to obtain citizenship.

Benefits of real estate investment

- Cheapest real estate market in all five Caribbean CBI countries

- Government-approved property starting from just $200,000

- Lowest cost of living of the five Caribbean CBI countries

- Cheapest total investment amount for a single CBI applicant

Average Dominica real estate prices

Dominica has one of the cheapest Caribbean real estate rent prices compared to all of the best Caribbean real estate investment islands, with an average monthly rental cost of $2,300 for a three-bedroom apartment. Approved property prices to gain Dominica citizenship start at around $3,000 per square meter.

Investors can secure property investments in approved projects, including Jungle Bay Villas, Bois Cotlette, Secret Bay Residences, Cabrits Resort Kempinski, the Silver Bay Development, and Tranquility Beach Dominica.

Grenada Real Estate Investment

Renowned for its white sand beaches, laidback lifestyle, and waterfalls, there are several key benefits to purchasing and owning Grenada investment properties to obtain citizenship through the country investment program.

Benefits of real estate investment

- A politically and economically stable country

- The ideal island for luxury living as the country sits outside the hurricane belt, eliminating the threat of hurricane damage.

- Visa free access to China with a Grenada passport

Average Grenada real estate prices

Investors will find Grenada investment properties ranging from $160,000 to $7 million. Grenada pre-approved citizenship by investment program properties cost around $3,000 to $5,000 per square meter. A joint purchase of a qualifying property requires a $220,000 investment, and a sole purchase requires a $350,000 investment.

St Kitts and Nevis Real Estate Investment

St Kitts and Nevis offers a luxurious lifestyle among beautiful natural landscapes and investment properties such as secluded homes, beach-front villas, and luxury resorts. Investors can find a Caribbean real estate investment for sale in St Kitts and Nevis that appeals to families and tourists visiting the twin island nation.

Benefits of real estate investment

- One of the Caribbean’s most stable economies with no local or worldwide income tax

- Multiple types of pre-approved investment properties are available

- Offers the most powerful Caribbean passport through obtaining citizenship by investment

- A stable tourism industry providing consistent rental income

Average St Kitts and Nevis real estate prices

Investors can expect to page $600,000 for a two-bedroom apartment in Basseterre, the country’s capital, and $1.5 to 2 million for luxury villas. If you’re seeking dual citizenship in St Kitts and Nevis, you must invest at least $400,000 for a joint purchase and $800,000 for sole ownership. Around 70 percent of real estate transactions are estimated to be undertaken within the country’s citizenship by investment program.

St Lucia Real Estate Investment

St Lucia real estate investment offers citizens and foreign buyers an excellent quality of life and the perfect environment to invest and live. Whether buying a holiday home for your family or investment property to rent out, St Lucia is one of the best Caribbean islands for real estate investment.

Benefits of real estate investment

- Among the best Caribbean islands providing a high quality of life at low living costs

- Lucrative real estate market

- No worldwide income tax and a high threshold for personal income tax

- Purchase Caribbean real estate in St Lucia and obtain St Lucia citizenship by investment

Average St Lucia real estate prices

Property prices in St Lucia vary depending on the property’s type, size, and location. $200,000 will secure property in local areas and towns. Buying property in sought-after modern real estate projects starts at $300,000, and beach-facing villas will set you back around $1 million.

The Process of Buying Property in the Caribbean

Purchases for citizenship by investment:

- Select your property: Look at the government-approved Caribbean real estate developments list and choose the most suitable option.

- Reserve your property: Once you’ve selected a suitable property, settle your agreement by paying around 10 to 15 percent of the total price into an escrow account.

- Apply for citizenship: Submit all your documentation, including the sale agreement, to the country’s Citizenship by Investment Committee.

- Receive approval and complete the purchase: You will receive an approval letter after two to six months. You can then complete the property purchase and send the documentation.

- Fulfill the due diligence process: Citizenship applicants must complete the country’s due diligence process to qualify for citizenship, which includes a remote interview.

- Receive citizenship: Once approved, you will receive a citizenship certificate, after which you can apply for a second passport.

General Caribbean real estate purchases:

- Choose the property: Once you select a suitable property, settle your purchase agreement by paying 10 to 15 percent of the total amount.

- Get an ALH license: If you are a foreign investor not from the Caribbean countries, you must apply for an Alien Landholding License (ALHL), which costs ten percent of the property price.

- Complete the purchase: Transfer the remaining amount to the developer’s account. It takes around seven days to complete the entire purchasing process. You can sign all purchase contracts in person in the presence of a notary public or through a lawyer with power of attorney.

- Register the property: Register new ownership of the property with the country’s local land department.

Expenses to Consider with Caribbean Real Estate Investments

Before buying real estate in St Kitts and Nevis, Grenada, or other Caribbean islands, foreign investors must acquire an AHL License, a land ownership license amounting to five to ten percent of the total transaction amount. The investor should consider license processing times. For example, an Antigua and Barbuda ALHL takes around six months to be processed.

Additionally, foreign investors must pay taxes and fees to the agency. Real estate investment to acquire citizenship also requires investors to pay special government fees. Dominica’s program has a government application fee of $25,000 for real estate investment.

There is also a three to six percent commission on the transaction amount. Therefore, direct purchase from a property developer is more cost-effective.

Caribbean Real Estate Fees and Taxes

Several Caribbean taxes should be considered when you buy real estate on a Caribbean island.

Country | ALHL | Stamp Duty Land Tax | Additional Taxes | Citizenship Program Fees |

Antigua and Barbuda | 5 percent | 2.5 percent | None | $30,000 |

Dominica | 10 percent | 4 percent | 3.5 percent | $25,000 |

Grenada | 10 percent | 1 percent | 10 percent transfer tax for properties over $7,500 | $50,000 |

Saint Kitts and Nevis | 10 percent | None | 0.2 percent | $35,000 |

Saint Lucia | $2,300-$4,200 | Depending on the area of the site | 2 percent | $50,000 |

Income tax rate

Country | Tax Resident | Non-Residents |

Antigua and Barbuda | None | 20 percent |

Dominica | None | Up to 35 percent |

Grenada | None | 10 to 30 percent |

Saint Kitts and Nevis | None | 10 percent (if withdrawing funds from income earned abroad) |

Saint Lucia | None | 10 to 30 percent |

Caribbean Property Maintenance Costs

Caribbean utility bills: In St Kitts and Nevis, basic utilities, including electricity, gas, water, and garbage collection, are cheap at around $95 per month compared to $205 in the United States. St Lucia is another cheap Caribbean with an average monthly cost of $95 for essential utilities.

Real estate insurance: Annual property insurance for Caribbean residential property in CBI countries is about 0.2 percent of the property’s value.

Service cost of the management company: Service costs depend entirely on the property type. For example, you must pay a service cost of around one to two percent for apartments and villas that cost around $200,000.

If you buy Caribbean real estate shares or apply through a citizenship program, you won’t need to pay direct property maintenance costs. This is because property management companies deduct the costs from the lease payments made to the property owner.

Renting out Caribbean Property

Foreign buyers obtaining citizenship by investment can list their Caribbean real estate investments for rent. A management company oversees the entire process. Typically, private investors and the developers share the rental income equally, which is mentioned in both the investors’ and management companies’ contracts.

Taxes on rental income differs for Caribbean tax residents. Non-residents get a tax ID to pay taxes. Those who have Caribbean state IDs can easily invest in Caribbean businesses.

Associated Costs with Property Ownership in the Caribbean

Annual property tax

Country | Tax Rate |

Antigua and Barbuda | 01. to 0.5 percent |

Grenada | 0.5 to 0.8 percent |

Saint Kitts and Nevis | 0.2 to 0.3 percent |

Dominica | 1.25 percent |

Saint Lucia | 0.25 to 0.4 percent |

Tax and fees of a sale

Sellers of the Caribbean real estate must pay a stamp duty of a certain amount of the property’s value, which varies from country to country. For instance, Grenadian stamp duty is much higher for foreigners than residents.

Country | Citizen | Foreign National |

Antigua and Barbuda | 7.5 percent | 7.5 percent |

Dominica | 2.5 percent | 2.5 percent |

Grenada | 5 percent | 1 to 5 percent |

Saint Kitts and Nevis | 5 to 18.5 percent | 5 to 18.5 percent |

Saint Lucia | 0 to 5 percent | 10 percent |

Get in touch with a Caribbean Citizenship by Investment specialist

Frequently Asked Questions about Caribbean Property Investment

Affordable properties are available across the entire Caribbean region. Dominica has the cheapest property market, with a low minimum investment of $200,000 to obtain citizenship through its citizenship program.

Caribbean real estate market stability varies as the Caribbean comprises many countries and territories. The Anguilla and the Cayman Islands real estate are renowned for their stability, luxury properties, and attractive investment opportunities. Antigua and Barbuda’s property market is largely propelled by foreign nationals seeking Caribbean citizenship.

Caribbean property investments are suitable for buyers seeking second citizenship through purchasing an approved residential and commercial property and those seeking a high rental yield on a licensed property.

US citizens can buy property on Caribbean islands without restrictions. Many Caribbean countries have relatively straightforward processes for foreign real estate ownership. Certain Caribbean countries, including St Kitts and Nevis and Dominica, actively encourage Americans to invest in property as part of their second citizenship by investment programs.

Owning property for rent in the Caribbean can be profitable, but its success hinges on which Caribbean island or territory the property is located, property management, and overall rental market demand. The Caribbean’s appeal as a popular tourist destination for many Americans and tourists worldwide, with the warm Caribbean Sea, year-round sunshine, and beautiful beaches, ensures a steady flow of visitors seeking rental accommodations.

The safest Caribbean island to buy a house depends on crime, natural disasters, political stability, and infrastructure. Caribbean islands like Grenada, the Cayman Islands, and Montserrat are considered relatively safe due to consistently low crime rates and stable governance. Grenada and Barbados present secure property investment opportunities due to their minimal risk of damage from natural disasters, being situated outside the hurricane belt that frequently affects the region.

The Cayman Islands is a Caribbean tax haven that charges no annual property taxes. Other Caribbean islands, including the Bahamas, the British Virgin Islands, Anguilla, and Turks and Caicos islands, do not impose annual property taxes.